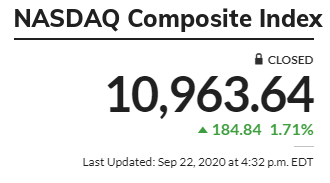

I mentioned last month that the stock market had already priced in an economic recovery that hasn’t happened yet. There’s been a little bit of a correction since then, but today it looks like there’s an urge to go back to the mania of overvaluation. Based on the rumor that some non-elected members of the administration would like more stimulus, the NASDAQ soared just shy of 2%:

What are the actual odds of a second stimulus getting passed, right now? Probably pretty close to zero. Following the death of Ruth Bader Ginsburg and McConnell’s expressed desire to ignore the precedent he tried to set four years ago, animosity in Washington is at peaks we haven’t seen in generations. Schumer has invoked certain Senate procedural tactics designed to slow down business and prevent as many appointments as possible before the new Senate (and possibly president) is sworn in.

Everything remains unstable

While job losses have slowed somewhat and new hiring has started picking up again, we’re still facing huge output reductions from this time last year. Many have exhausted both traditional state unemployment as well as the additional federal assistance that was provided both as universal stimulus and as a supplement to those state insurance programs.

And although Trump announced more help was on the way, those promises were predictably hollow.

Without funding to back up the declaration, very few states were able to find any additional resources to increase unemployment checks. The few that did – mostly red states – raided cash from the state’s FEMA emergency balance. As such, the money did not last long, and now represents additional funding the government will have to come up with to handle the next environment disaster. Oh did I mention environmental disasters? Because there are also hurricanes and fires and a pandemic that will probably have to be dealt with at some point.

But about those stocks…

I suppose things brings me back around to the original topic here: stocks.

Yeah, I wouldn’t suggest investing in these current prices. Even if we ignore the obvious economic and ecological problems, getting in at this price level is a bet on the fact that Chuck Schumer and Mitch McConnell are suddenly going to agree on how to fix the current mess we call a country.

Beyond that, prices are still too high and the rally has gone well past the actual economic recovery. While the most stubborn bulls might insist that profits can be separated from the overall health of the labor markets and widespread prosperity, it would be wise for them to check the history books for examples of that lasting very long.